By Ivan Pereira

A major and meticulously crafted identity theft ring allegedly run by a fugitive St. Albans businessman was shut down after a 21−month investigation, the Queens district attorney announced last Thursday.

Nearly four dozen people accused of working for the ring, divided into three identity theft groups, were charged on various counts, including identity theft for reportedly stealing credit cards and personal credit information from thousands of American and Canadian customers, the DA said. The perpetrators cost the victims and their banks more than $12 million in losses over the last year, according to DA Richard Brown.

“Our investigation reveals that … this is one of the largest identity theft networks uncovered in recent history and is just possibly the tip of a much larger global credit card trafficking organization,” he said in a statement.

The plan involved an organized setup among 45 individuals who would make major electronics purchases in other people’s names, according to Brown.

“Account preparers” would activate the accounts by impersonating the account holder through a device called “Spoof Card” and requesting a bank change a PIN, and mailing address and increase the account’s credit limit, according to Brown. The Spoof Card allows a caller to mask his or her voice and change the number displayed on the receiving end’s caller ID.

“They are virtually untraceable and can be used by identity thieves and hackers to pose as government and financial entities as a means to unscrupulously obtain personal information from unsuspecting consumers and also by defendants in domestic violence cases to harass their victims,” the DA explained.

“Account maintainers” would pay off the accounts to avoid fraud detection, by using funds from one account to pay off another, and “account washers” would be responsible for obtaining as much information on the account’s real owner Brown said.

Whole “Shola” Ogunwen, of 187−47 Ilion Ave. in St. Albans, was the alleged leader of Shola Enterprise, which supplied the credit accounts to subordinates who managed the local identity theft cells, according to the DA. Foot soldiers would use the accounts to charge for expensive purchases and they would fence the purchases to the operator of an electronics store in Brooklyn, the DA said.

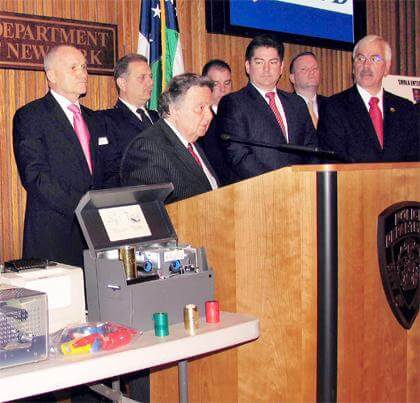

The police began investigating and arresting members of the identity theft rings in September 2007 and have continued rounding up the suspected thieves, he said. Police searches executed early last week at 17 locations across the city resulted in the recovery of forged credit cards, credit reports, machines used to stamp credit card info onto cards and nearly $100,000, Brown said.

Although Ogunwen has been indicted on several charges, including grand larceny, he had not been apprehended by the police as of press time Tuesday, according to Brown. Three of the indicated people believed to have been involved with Ogunwen were also charged in separate counts for operating two smaller identity theft rings, the DA said.

Reach reporter Ivan Pereira by e−mail at ipereira@cnglocal.com or by phone at 718−229−0300, Ext. 146.