By Howard Koplowitz

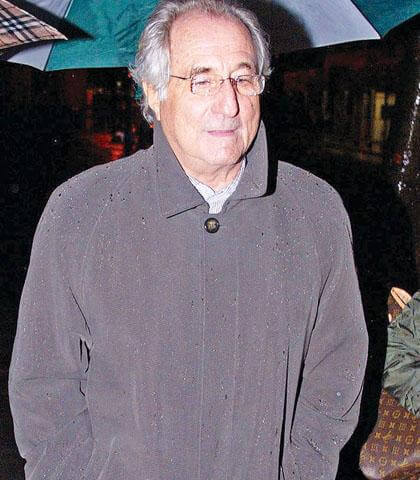

Three Queens congressional members who sit on the House Financial Services Committee grilled but received few answers from the watchdog for the Securities and Exchange Commission and the head of the corporation that will be paying out claims to investors duped in the $50 billion Ponzi scheme allegedly perpetrated by Bernard Madoff, a Rockaway native.

The hearing Monday was set up in an attempt by Congress to find out how Madoff was able to go through what authorities describe as a massive fraud despite federal agencies that are supposed to hold financial firms accountable.

“I want to know who is responsible for protecting the securities industry because I want to tell them they suck at it,” U.S. Rep. Gary Ackerman (D−Bayside) said. “This is worse than a nail in the coffin. This is a stake in the heart of the investment community.”

He aimed the remark at SEC Inspector General David Kotz and John Harbeck, the president and chief executive officer for the Securities Investor Protection Corporation, a non−governmental agency that will be paying out up to $500,000 apiece to Madoff investors.

U.S. Rep. Carolyn Maloney (D−Astoria) noted that Madoff’s firm, Bernard L. Madoff Investment Securities, handled billions of dollars in investments, but hired a low−level accounting firm to audit its books.

She asked Kotz if the suspected fraud would have been harder to commit if a reputable third party had done the audits, but he only said that his office “would look carefully” at that in an internal investigation of the SEC’s handling of Madoff.

Maloney also asked what the minimum qualifications should be for SEC auditors, but Kotz did not directly answer the question.

“Many of us have lost confidence in the SEC,” Maloney said.

She said there were complaints about Madoff filed with the agency from whistleblowers, but the SEC failed to respond.

“What is so frustrating about this is we could have responded to this if we had responded to the whistleblower complaints,” Maloney said.

Kotz acknowledged that the SEC received complaints about Madoff. But he contended they were sent to the agency’s enforcement arm and not forwarded to the inspector general’s office.

U.S. Rep. Gregory Meeks (D−St. Albans) said Madoff was nothing short of a “crook” and suggested there needed to be stronger regulations to prevent large−scale fraud from occurring again.

A Georgia congressman raised the possibility that Madoff had help from within the SEC to perpetrate the alleged scheme. He noted that SEC investigators questioned Madoff eight times in the past 16 years, but the probes went nowhere.

“You got some folks with you in the SEC working for Mr. Madoff,” said U.S. Rep. David Scott (D−Ga.). “Their heads have to roll.”

Reach reporter Howard Koplowitz by e−mail at hkoplowitz@timesledger.com or by phone at 718−229−0300, Ext. 173.