By Ivan Pereira

The state took more steps last week to improve the way foreclosures are handled with a court ruling and a measure passed in Albany, and a southeast Queens housing group said both will go a long way for the residents who are in the center of the mortgage crisis.

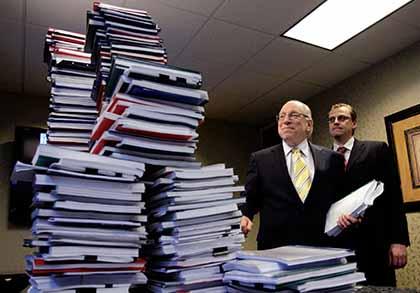

On Oct. 20, the state court system instituted a new filing requirement that mandates a homeowner’s lawyers sign off on the paperwork during several stages during the foreclosure process, including five business days leading up to the auction of the house.

Chief Judge Jonathan Lippman said the measure was made in light of revelations that financial institutions, such as Bank of America, JP Morgan Chase and others, were implementing thousands of foreclosures without going through the paperwork meticulously and doing necessary procedures for each filing.

“This new filing requirement will play a vital role in ensuring that the documents judges rely on will be thoroughly examined, accurate and error-free before any judge is asked to take the drastic step of foreclosure,” he said in a statement.

JP Morgan, GMAC and PNC Financial suspended their foreclosure proceedings while they investigated their records for any errors. Bank of America initially had a similar halt, but resumed its foreclosure proceedings Monday after the bank said it did find a large number of errors in its paperwork.

While the issue of rubber-stamped foreclosures gets settled, state Assemblyman Rory Lancman (D-Fresh Meadows) said a newly created law he co-sponsored will help out homeowners who are going through the foreclosure process.

The Access to Justice in Lending Act, which was signed into law Oct. 20, allows borrowers who successfully defend themselves against foreclosure proceedings to collect attorney’s fees from their banks. Lancman said the measure helps to give an incentive to attorneys to represent poor homeowners and would prevent foreclosures from slipping through the cracks.

“If homeowners had the money to pay for a lawyer to represent them in foreclosure, they probably wouldn’t be in foreclosure in the first place,” he said in a statement. “This legislation will allow lawyers to take on meritorious foreclosure cases with the fair and reasonable expectation that they will be compensated if they succeed,” he said in a statement.

Housing advocates, such as Neighborhood Housing Services of Jamaica, said the two moves are beneficial to homeowners in southeast Queens, which leads the state in the number of foreclosures.

Representatives of the nonprofit said their office has been inundated with victims who have had trouble getting legal help to sift through all the confusing paperwork and the state’s assistance will yield positive results for the homeowners.

“This bill is not a windfall to the mortgagers but is merely an attempt to provide rights to mortgagers similar to rights that are already enjoyed in other real property contractual relationships,” NHS said in a statement.

Reach reporter Ivan Pereira by e-mail at ipereira@cnglocal.com or by phone at 718-260-4546.