By Ivan Pereira

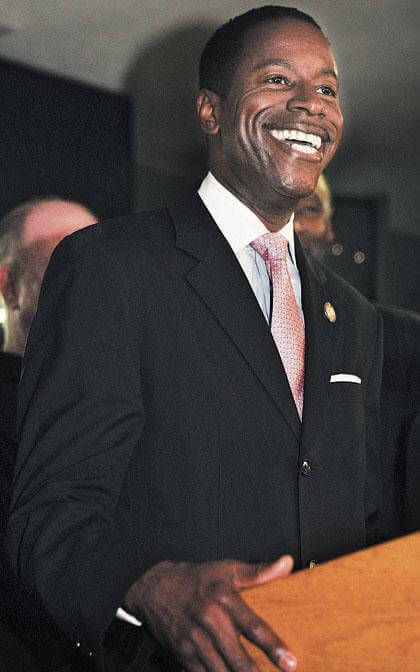

With tax season around the corner, state Sen. Malcolm Smith (D-St. Albans) wants southeast Queens taxpayers to get their fair share in returns.

The senator has been making a push to get more of his constituents to apply for the federal government’s Earned Income Tax Credit program. Taxpayers who make roughly $48,000 or less can get credit on their tax returns if they file their returns and apply for the program.

“An estimated 20 [percent] to 25 percent more people than currently collect EITC may qualify but may not be aware of it. I urge all New Yorkers who think they may qualify to contact the Internal Revenue Service to determine eligibility,” Smith said in a statement.

More people can qualify for EITC due to declining income, marriage or more children in the family, according to Smith. Families with three or more children are eligible for a larger credit.

“The Earned Income Tax Credit is for hardworking New Yorkers with moderate to low-incomes, those with limited English skills, disabilities and non-traditional families, such as a grandparent raising a grandchild,” Smith said.

For more information, log on to irs.gov/individuals/article/0,,id=130102,00.html or call 1-800-829-1040.

Reach reporter Ivan Pereira by e-mail at ipereira@cnglocal.com or by phone at 718-260-4546.