By Joe Anuta

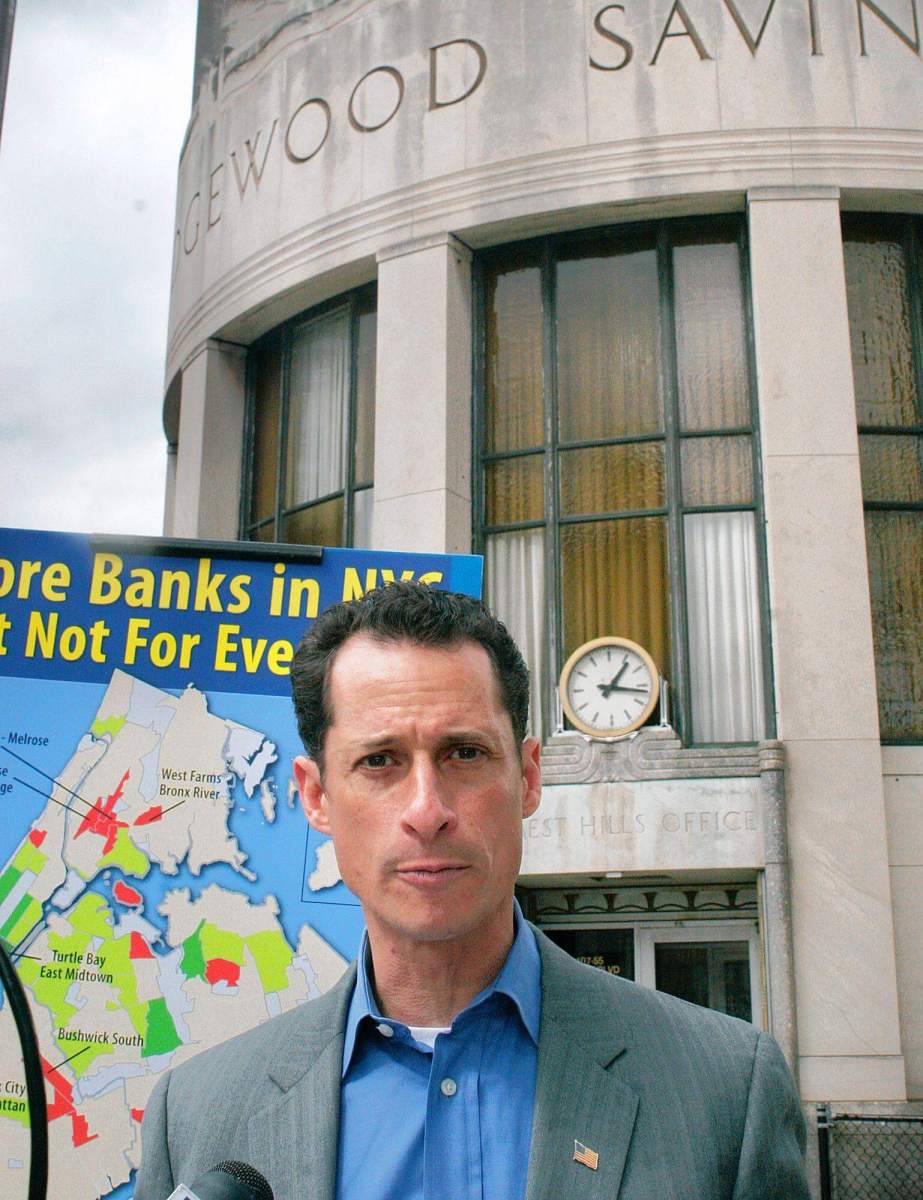

Low-income neighborhoods in the borough suffer from a lack of banks, and it is up to the federal government to coax more lending institutions into opening offices in underserved areas, U.S. Rep. Anthony Weiner (D-Forest Hills) said in Forest Hills Monday.

Weiner released a study claiming that the borough’s banks are concentrated in the wealthy neighborhoods and that the lack of banks in poorer areas deprives those residents of credit for small businesses and personal loans.

“We need to start doing this based on where the money is needed, not where the money already is,” Weiner said. “In South Jamaica we have a great deal of demand.”

Yet since 2006, only one bank has been built in that neighborhood — which has a $39,000 median household income — bringing the grand total to one.

Citywide, in neighborhoods with a median household income above $53,000, there is a bank for every 2,300 people. Neighborhoods with a median household income below $31,000 have only one bank for every 9,000 people, according to Weiner’s study.

And Weiner said that it is not because of a lack of demand.

“We want the Federal Deposit Insurance Corp. to look at the requests [banks] have got and see whether or not those requests have been fulfilled.”

It is all part of “The Weiner Plan,” which is a set of initiatives designed to entice banks to lend in low-income neighborhoods through a federal program called The Community Reinvestment Act.

The program works by rating banks for how well they serve low-income areas. But, according to Weiner, 98 percent of banks get a a favorable rating despite clearly concentrating branches in higher-income areas.

“The banks followed the big, high earners and now big swaths of New York City don’t have banking services,” he said.

The neighborhood with the largest amount of banks was Flushing with 33. Western Queens enjoyed more banks on the whole than southern or eastern Queens.

Hollis, Ozone Park, East Elmhurst, East Flushing, Baisley Park and Springfield Gardens had no banks, according to Weiner’s study.

Weiner said the federal government needs to modify the way it rates the banks. More weight should be given to banks who lend in poorer neighborhoods, and banks which do not should be penalized, Weiner said.

On a citywide level, Queens has added half as many bank branches compared to Manhattan, despite having a much larger population.

Peter Boger, president of Ridgewood Savings Bank, said that the increase in Manhattan is probably made up of larger corporate banks. Smaller neighborhood banks like Ridgewood often stay in more residential areas, he said.

Boger only operates two banks in Manhattan on the Upper West Side despite having more than 30 branches in the area.

Reach reporter Joe Anuta by e-mail at januta@cnglocal.com or by phone at 718-260-4566.