By Ivan Pereira

City Comptroller John Liu, his state counterpart Thomas DiNapoli and representatives of other government pension funds across the nation are urging the largest banks to re-examine their procedures that cost not thousands of residents their homes.

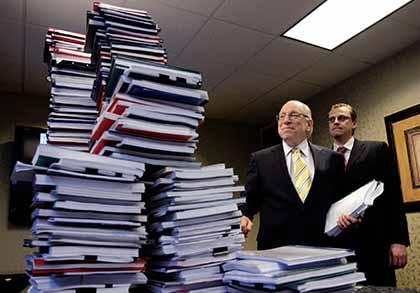

Liu and DiNapoli, along with a coalition of government pension fund groups from Connecticut, Illinois, North Carolina and Oregon, sent letters Monday to Bank of America, Citigroup, JP Morgan Chase and Wells Fargo that requested that their audit committees launch independent investigations into their loan modification, foreclosure and securitization policies and procedures.

The banks halted their foreclosure proceedings for a few weeks in the fall after it was discovered that they made some errors in the foreclosure proceedings. In some cases, courts signed off on the foreclosures without examining the paperwork thoroughly.

Since the four banks account for $5.7 billion in investments in the coalition’s pensions, Liu said there should be no room for error when handling the mortgages.

“There is a fundamental problem in their procedures that endangers not just homeowners, but shareholders and local economies,” he said in a statement.

Aside from the effect on the pensions, the oversight by the banks had a serious effect on the large number of foreclosures in Queens, according to housing rights activists. Southeast Queens neighborhoods such as Jamaica, St. Albans and Springfield Gardens lead the state in the number of defaulted home mortgages and the number has not decreased over the years.

Many families did not have the legal resources to check over their paperwork and may have lost the chance to save their homes, according Neighborhood Housing Services of Jamaica.

The coalition recommended that the audit committees should hire independent advisers to review their foreclosure policies, staff training and compliance with federal and state laws.

“For the purposes of this review, we do not consider your existing audit firm to be independent since the firm previously signed off on the [bank’s] internal controls,” the letter read.

DiNapoli said he hopes the banks comply with the request and future mishaps can be prevented.

“As investors, we need to understand what happened. A full and open examination of the procedures used to foreclose on millions of families is the only way to make sure our investments are protected and no one is ever wrongfully evicted from their home,” he said in a statement.

Reach reporter Ivan Pereira by e-mail at ipereira@cnglocal.com or by phone at 718-260-4546.