By Philip Newman

Gov. Andrew Cuomo has signed legislation cutting back a payroll tax passed in 2009 to rescue the financially imperiled MTA, which has been assured any lost revenue will be made up by the New York state Legislature.

Cuomo signed the new law on Long Island, site of much of the outcry against the payroll tax, which was effective in the 12 counties served by the Metropolitan Transportation Authority.

The new legislation provides tax relief for nearly 300,000 small businesses and self-employed New Yorkers. The tax on businesses with an annual payroll under $1.5 million would be reduced by 0.11 percent and drop to 0.23 percent for businesses with payroll less than $1.75 million for a total savings of $250 million across the state. Businesses whose payroll is below $1.25 million got a permanent reprieve.

The deal came as part of an overhaul of the state tax code, which will lower taxes for the middle class and raise taxes for the state’s richest citizens.

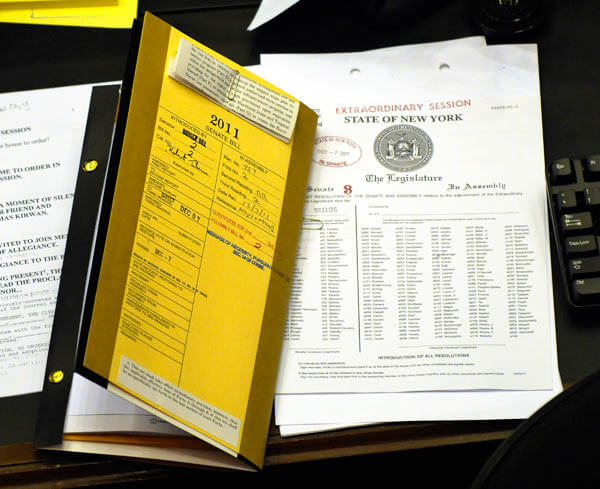

The governor’s office said that “on Dec. 7, the Legislature passed the governor’s middle-class tax cut and job creation legislation, reducing the MTA payroll tax on small businesses while maintaining the necessary funding for the MTA from other sources.”

The new measure will have no effect on MTA funding since the state will reimburse the MTA for all revenue that has been eliminated by the tax reduction, the governor’s office said.

State Sen. Joseph Addabbo (D-Howard Beach) pointed out that the payroll tax legislation eliminated the MTA payroll tax for private and parochial schools.

Opposition was great throughout the area where the MTA tax was effective, but particularly heavy on Long Island, where the MTA’s Long Island Rail Road and Nassau Bus operate. Nassau Bus recently withdrew from the MTA. The MTA had declined to maintain the level of financial subsidy for the bus line the agency had long maintained.

A leader of the opposition to the tax was state Senate leader Dean Skelos (R-Nassau).

“The MTA payroll tax has been an enormous burden on businesses and we now are lifting that burden,” said Skelos about the legislation signed in West Hempstead, L.I., Monday.

“We are grateful to the governor, majority leader and speaker for reaching an agreement that ensures the MTA will continue to receive the level of funding needed to keep New York and its economy moving,” the MTA said following passage of the tax reduction legislation.

The MTA payroll tax provided 14.3 percent of the MTA operating budget.

Although the new legislation pledged to make good to the MTA all money taken away by the payroll tax reduction, some transit activists have questioned where such funds would come from in a state long in financial distress.

Reach contributing writer Philip Newman by e-mail at timesledgernews@cnglocal.com or phone at 718-260-4536.